President Joe Biden announced a plan on Aug. 24 to cancel student loan debts for millions of borrowers, but some San Jose State community members say it has political and economic ramifications.

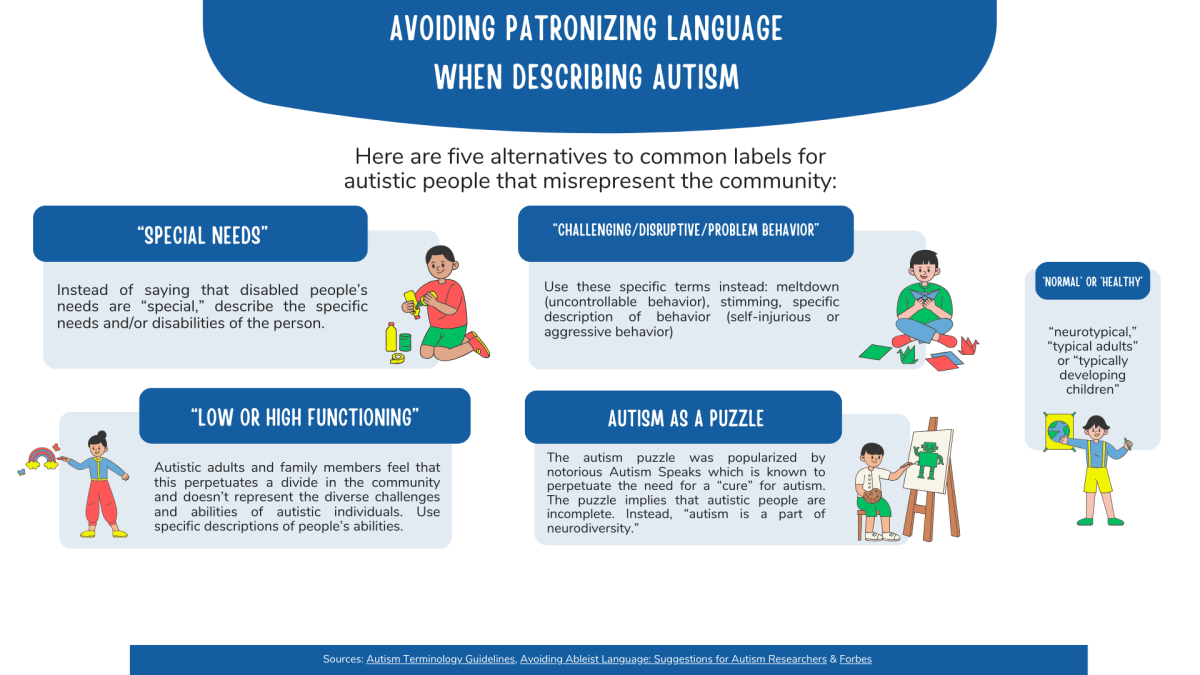

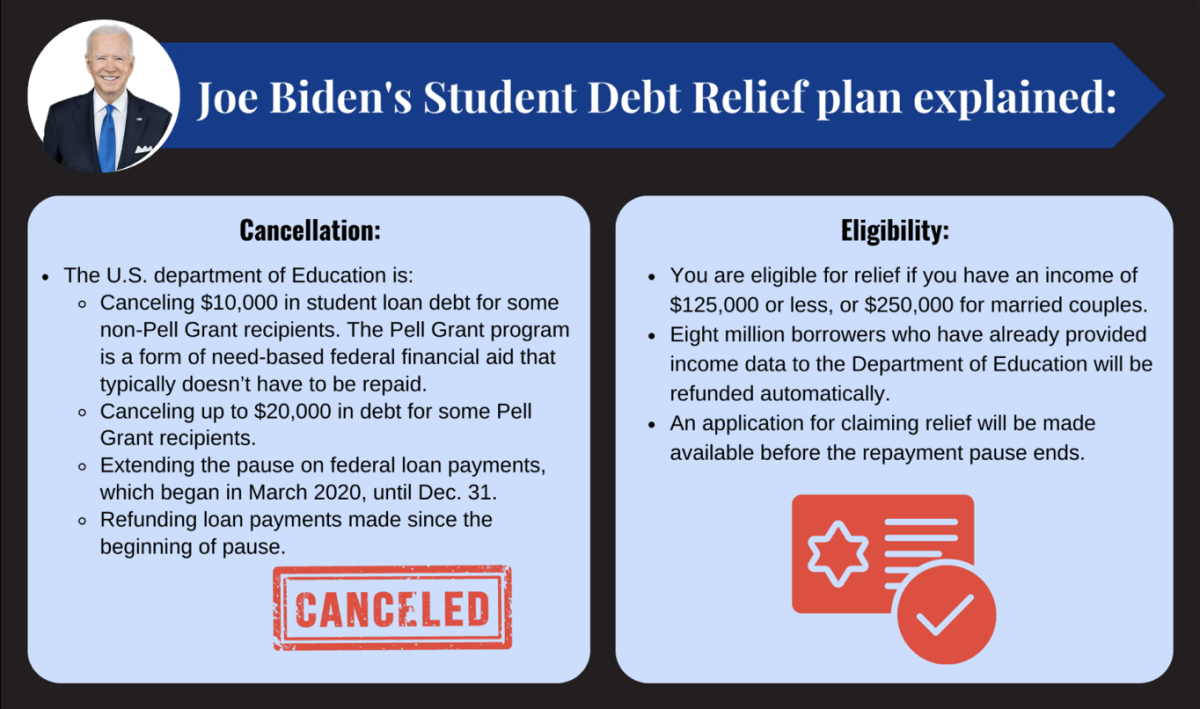

The plan will cancel $10,000 in debt for students who have incomes less than $125,000 per year and up to $20,000 for those who borrowed money from the Pell Grant program, which is a form of need-based federal financial aid that typically doesn’t have to be repaid, according to the White House fact sheet.

Roughly 43 million Americans hold federal student loan debt of $1.6 trillion total, according to the U.S. Student Loan Debt data.

Economics assistant professor Justin Rietz said Biden’s loan forgiveness plan is a clear advantage, but there will be societal consequences.

“What students will not pay, will be paid by taxpayers,” Rietz said.

The student loan debt relief plan will cost $400 billion to the U.S. taxpayers. The earlier estimates reported an average burden per taxpayer of $2,503, According to the National Taxpayers Union Foundation.

Rietz said even if raising taxes can have negative consequences, the major effects of the plan can be inflationary.

“Now there is a large group of people who have more money in their hands, people who have [paid] their debt off,” Rietz said. “They can spend that money in other ways, prices can go up and of course, education is included in this trend.”

He said there is a possibility that education costs will rise in the near future as a direct effect of the plan, which will translate into new student loans.

“For individual students receiving debt forgiveness is clearly positive,” Rietz said. “But from a societal perspective, it is not clear what is going to happen in terms of economic consequences.”

He said even if it is difficult to predict the effective consequences of the plan, the possibility of an inflationary scenario is real and it will be directly connected to higher costs in education.

Marketing senior Nigel Pun said the ramification of inflation concerns him.

“I will not be directly affected by the plan,” Pun said. “But I will indirectly feel the debt relief through inflation, affecting my living costs like food and rent.”

He said he thinks the plan’s inflationary consequences will be similar to the inflation caused by coronavirus stimulus checks, which were checks issued in 2020-22 by the Internal Revenue Service.

“Student debt relief is one of the points that young adults have been pushing for without necessarily understanding the economic ramification,” Pun said. “An economy already running hot cannot handle more fuel and this will lead to a drastic crash that will not end well.”

Besides the economical and financial effects that the plan will have on both college students and the U.S. economy, Pun said there are also political elements that are strongly linked to the student loan debt cancellation.

“The debt relief is definitely a last-resort political tactic to recover [Biden’s] approval rate that bottomed in May, June and July,” he said.

Biden’s public approval rate fell to 36% in July, which was the lowest rating of his 19 months as president, according to a July 19 Reuters article.

However, President Biden saw a six-point gain from July in a recent Gallup poll, according to a Friday article by Bloomberg, which is a private and economics-based newsgroup in New York.

“My personal opinion is that Biden worked to cancel student debt to recapture the support of young adults, particularly those in the Democratic Party,” Pun said.

James Brent, master of public administration director and political science associate professor, said even if the student debt relief is a political strategy, it does not have to be perceived as negative.

“Of course it is political,” Brent said. “Over the last decade, one of the main dividing lines that has risen between Democrats and Republicans is that college graduates have gravitated more toward the Democrats while people who did not graduate gravitate more toward the Republicans.”

Brent said the plan is a policy that rewards the Democratic base, adding that Democrats have pursued it over the years because “they believe that is a good public policy.”

He said the policy can also spark good results for Biden in terms of popularity among young adults.

“For President Biden, this helps in strengthening his appeal among young voters and more progressist voters,” Brent said. “Which it does not mean to be in contrast with the positive effects of the debt relief.”

Overall it can be perceived as a preliminary step toward a more important achievable result, he said.

“Generally, Democrats simply believe that education should be cheaper or perhaps free,” Brent said. “In this case, the student loan debt relief is just an incredibly small step toward that definitive goal.”